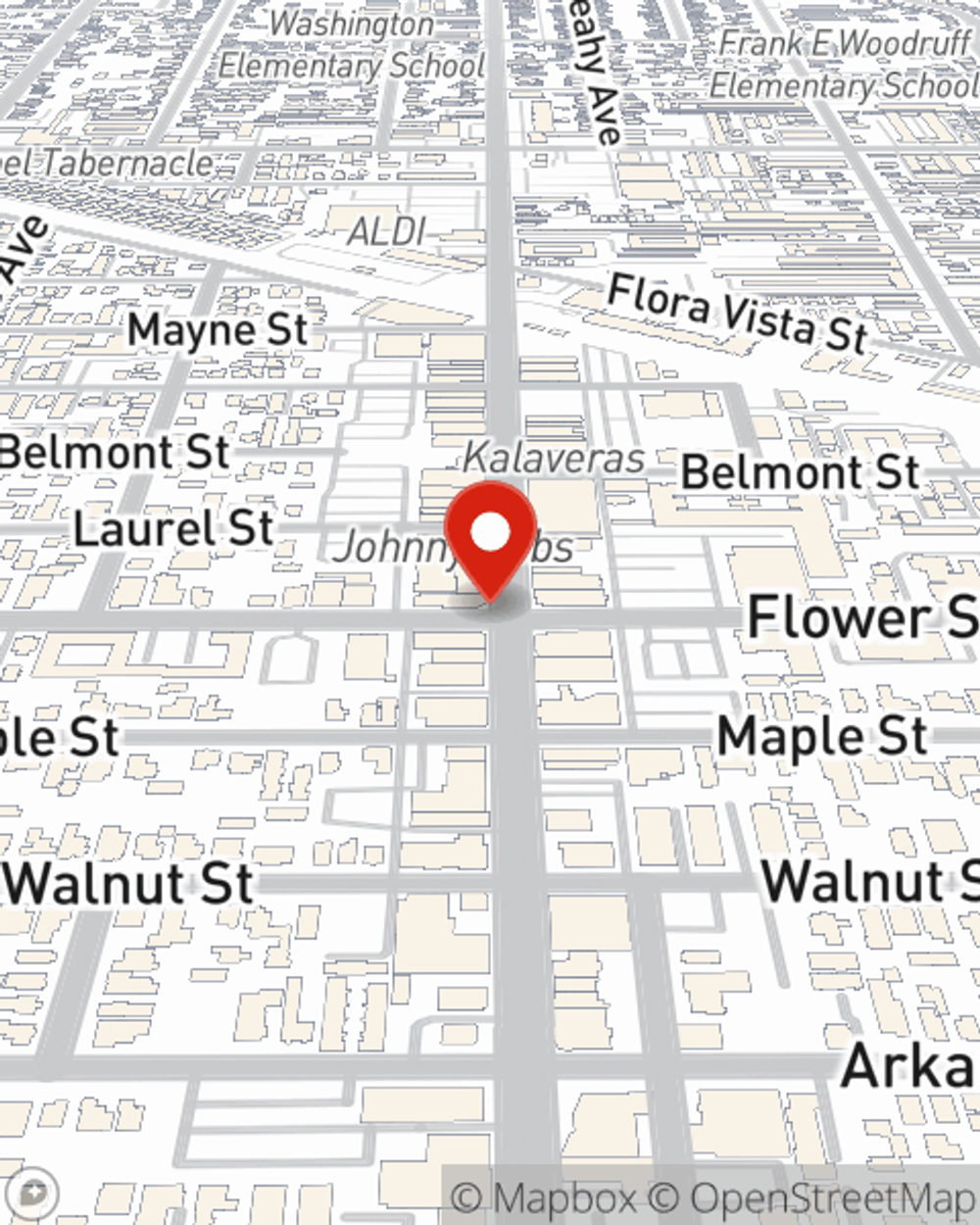

Homeowners Insurance in and around Bellflower

Looking for homeowners insurance in Bellflower?

Help protect your home with the right insurance for you.

Would you like to create a personalized homeowners quote?

- Bellflower, Ca

- Lakewood, Ca

- Paramount, Ca

- Norwalk, Ca

Home Is Where Your Heart Is

Your house isn't a home unless you enjoy coverage from State Farm. This excellent, secure homeowners insurance will help you protect what you value most.

Looking for homeowners insurance in Bellflower?

Help protect your home with the right insurance for you.

Safeguard Your Greatest Asset

For insurance that can help protect both your home and your valuables, State Farm has options. Agent Eduardo Mendoza's team is happy to help you build a policy today!

Having great homeowners insurance can be invaluable to have for when the unpredictable arises. Reach out to agent Eduardo Mendoza's office today to figure out what works for your home insurance needs.

Have More Questions About Homeowners Insurance?

Call Eduardo at (323) 581-8270 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Curb appeal ideas to help refresh the exterior of your home

Curb appeal ideas to help refresh the exterior of your home

Here are some curb appeal ideas that might help spruce up the exterior of your home.

Eduardo Mendoza

State Farm® Insurance AgentSimple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Curb appeal ideas to help refresh the exterior of your home

Curb appeal ideas to help refresh the exterior of your home

Here are some curb appeal ideas that might help spruce up the exterior of your home.